Beyond The Desk: Get Paid Smarter, Grow Faster: The Power of Tracking Days to Pay and Days Outstanding

- Nick Andriacchi

- Aug 21, 2025

- 2 min read

They sound similar but they measure two different things and understanding both is critical in staffing and cash flow management. Here’s the breakdown in plain language:

Days to Pay (DTP)

· This measures how long your clients take to pay you.

· It’s calculated from the invoice date to the date payment is received.

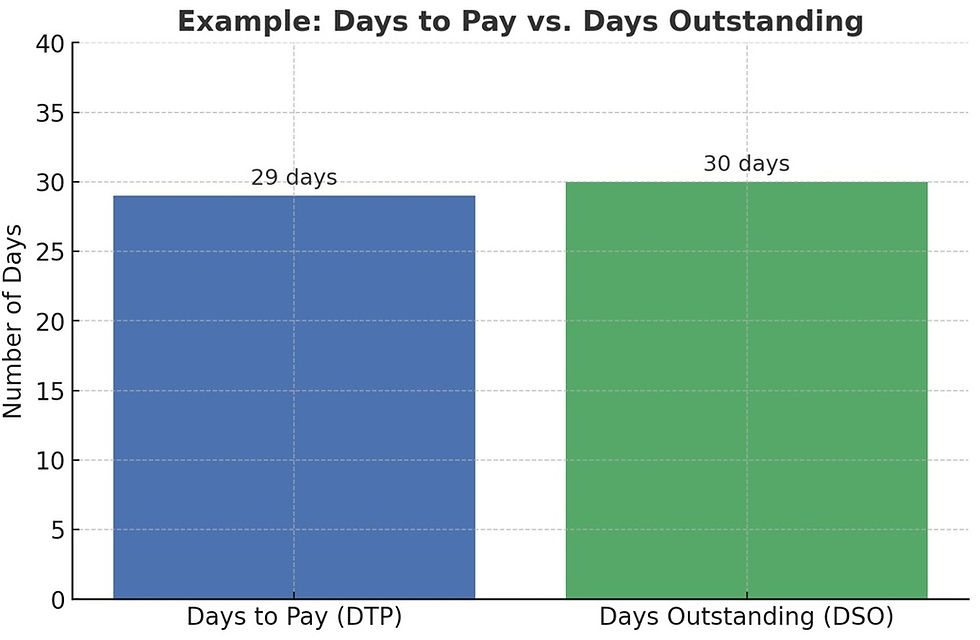

· Example: If you invoice a client on June 1 and they pay on June 30, their Days to Pay is 29.

· Why it matters: It shows client payment behavior and directly impacts your cash flow. Longer DTP means you’re essentially financing your client’s payroll longer.

Days Outstanding (DSO)

· This measures how long, on average, your invoices sit unpaid across your entire receivables portfolio.

· It’s calculated by dividing accounts receivable balance by average daily sales.

· Example: If you have $300,000 in receivables and your average daily sales are $10,000, your DSO is 30.

Why it matters: It’s a broader company-level metric that shows how efficient you are at converting invoices into cash. It blends together all clients and gives you a big-picture view of collections performance.

Why the difference matters:

· A client with a Days to Pay of 40 might seem fine, but if invoicing delays, disputes, or errors push your overall DSO to 50+, you’re actually tying up more cash than you think.

· DTP is about client habits. DSO is about your entire process—invoicing speed, accuracy, collections follow-up, and client compliance.

· Staffing companies especially need to watch both, because payroll goes out weekly while receivables come in much later. If DTP and DSO stretch, you’re covering that gap with working capital or funding, which costs money.

In both cases, these calculations should be weighted in order to smooth out aberrations. For example. a staffing company may have 4 small clients that pay very quickly and 2 large clients that pay slower. A straight average may produce a DTP and DSO that is artificially low because the majority of the dollars (invoices) come in late.

👉 Bottom line: Tracking both metrics helps you see not just when clients pay, but also how well your business turns invoices into cash.

For a staffing company to grow, access to unlimited cash is essential I have been lending to the staffing industry for over 30 years and have helped thousands of staffing companies reach their potential. Don’t let another client slip by because you don’t have the cash to finance payroll.

Call me 312-933-7712 or email nandriacchi@madisonresources.com for more information.

Comments