July 2022 Jobs Numbers

- Nick Andriacchi

- Aug 15, 2022

- 4 min read

The Fed is Sooo Wrong

As the fed (which was about a year late to the party) continues to aggressively raise rates to tame inflation, staffers are doing the real work that will fix the inflation problem. The inflation issues we have now was not caused by an economy that was overheating, it was caused by incentivizing people and company’s to not produce. Free money caused too much demand and not enough supply.

GDP has dropped in the last 2 quarters so technically the USA is in recession. Why raise rates to tame inflation by reducing growth when the root cause of inflation is not enough talent in the workforce?

Staffers are doing a great job at filling open jobs. More people in the workforce will lessen supply shortages, increase productivity, and lower inflation.

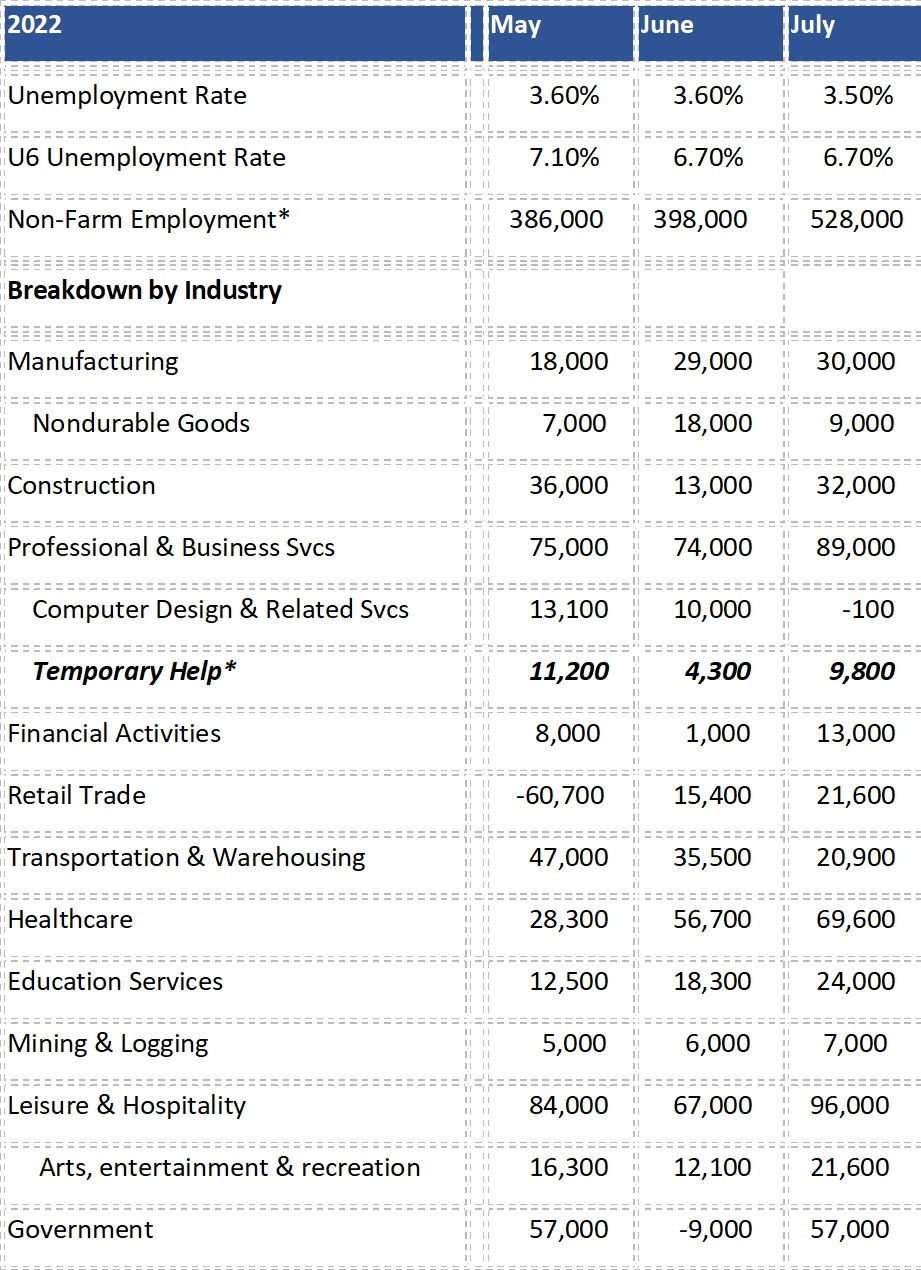

July’s top-line number came in much better than expected. Strong gains in education, health care, and professional services.

July Employment Summary

· The economy added 528,000 jobs in June, more than expected, and wages grew by a solid 0.5%, or 5.2% year over year.

· Job openings, a measure of labor demand, were down 605,000 to 10.7 million on the last day of June, the fewest since September 2021, the JOLTS report showed. June's decline was the largest since April 2020, when the economy was reeling from the first wave of the COVID-19 pandemic.

· The jobs-workers gap fell to 2.9% of the labor force from 3.3% in May. It is down from its peak of 3.6% of the labor force in March, an improvement economists at Goldman Sachs said suggested wage growth should slow in the second half of the year. Annual wage growth in the second quarter was the fastest since 2001.

Analysis of the July Employment Report

· A more encompassing measure of unemployment (U6) that includes discouraged workers and those holding part-time jobs for economic reasons at 6.7%.

· Prime age labor force participation rate (ages 25-54) was up this month to 82.4%. I view this number as very disappointing as and it is still off by .6% from February 2020, the last month before the pandemic started.

· The overall labor force participation is 62.1% down .1% from last month.

· In July, average hourly earnings for all employees on private nonfarm payrolls rose by 15 cents, or 0.5 percent, to $32.27. Over the past 12 months, average hourly earnings have increased by 5.2 percent. In July, average hourly earnings of private-sector production and nonsupervisory employees rose by 11 cents, or 0.4 percent, to $27.57.

· In July, the average workweek for all employees on private nonfarm payrolls was 34.6 hours for the fifth month in a row. In manufacturing, the average workweek for all employees held at 40.4 hours, and overtime increased by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained unchanged at 34.0 hours

· APD is retooling their monthly report. Estimated publishing date August 31st 2022

Source: ADP, BLS, CNBC, ABC News

JOB OPENINGS AND LABOR TURNOVER – JUNE 2022

The number of job openings decreased to 10.7 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Hires and total separations were little changed at 6.4 million and 5.9 million, respectively. Within separations, quits (4.2 million) and layoffs and discharges (1.3 million) were little changed. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

Job Openings

On the last business day of June, the number and rate of job openings decreased to 10.7 million (-605,000) and 6.6 percent, respectively. The largest decreases in job openings were in retail trade(-343,000), wholesale trade (-82,000), and in state and local government education (-62,000).

Hires

In June, the number and rate of hires were little changed at 6.4 million and 4.2 percent, respectively. Hires were little changed in all industries.

Separations

Total separations includes quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations includes separations due to retirement, death, disability, and transfers to other locations of the same firm.

In June, the number and rate of total separations were little changed at 5.9 million and 3.9 percent, respectively. Total separations were little changed in all industries.

In June, the number of quits was little changed at 4.2 million. The rate was unchanged at 2.8 percent. Quits decreased in construction (-51,000). Quits increased in state and local government education (+14,000).

In June, the number of layoffs and discharges was little changed at 1.3 million. The rate was unchanged at 0.9 percent. Layoffs and discharges decreased in wholesale trade (-26,000), finance and insurance (-25,000), and in federal government (-4,000).

The number of other separations was little changed in June at 367,000. Other separations decreased in real estate and rental and leasing (-9,000). Other separations increased in transportation, warehousing, and utilities (+9,000); durable goods manufacturing (+6,000); educational services (+3,000); and in federal government (+3,000).

Establishment Size Class

In June, the job openings rate increased in establishments with 1,000 to 4,999 employees. The hires rate decreased in establishments with 1,000 to 4,999 employees and in establishments with 5,000 or more employees. For a more in-depth description of the JOLTS establishment size class estimates, please visit

www.bls.gov/jlt/sizeclassmethodology.htm.

____________

The Job Openings and Labor Turnover Survey estimates for July 2022 are scheduled to be released on Tuesday, August 30, 2022 at 10:00 a.m. (ET).

Comments