Has the Fed Achieved a "Soft Landing"

- Nick Andriacchi

- Apr 10, 2023

- 4 min read

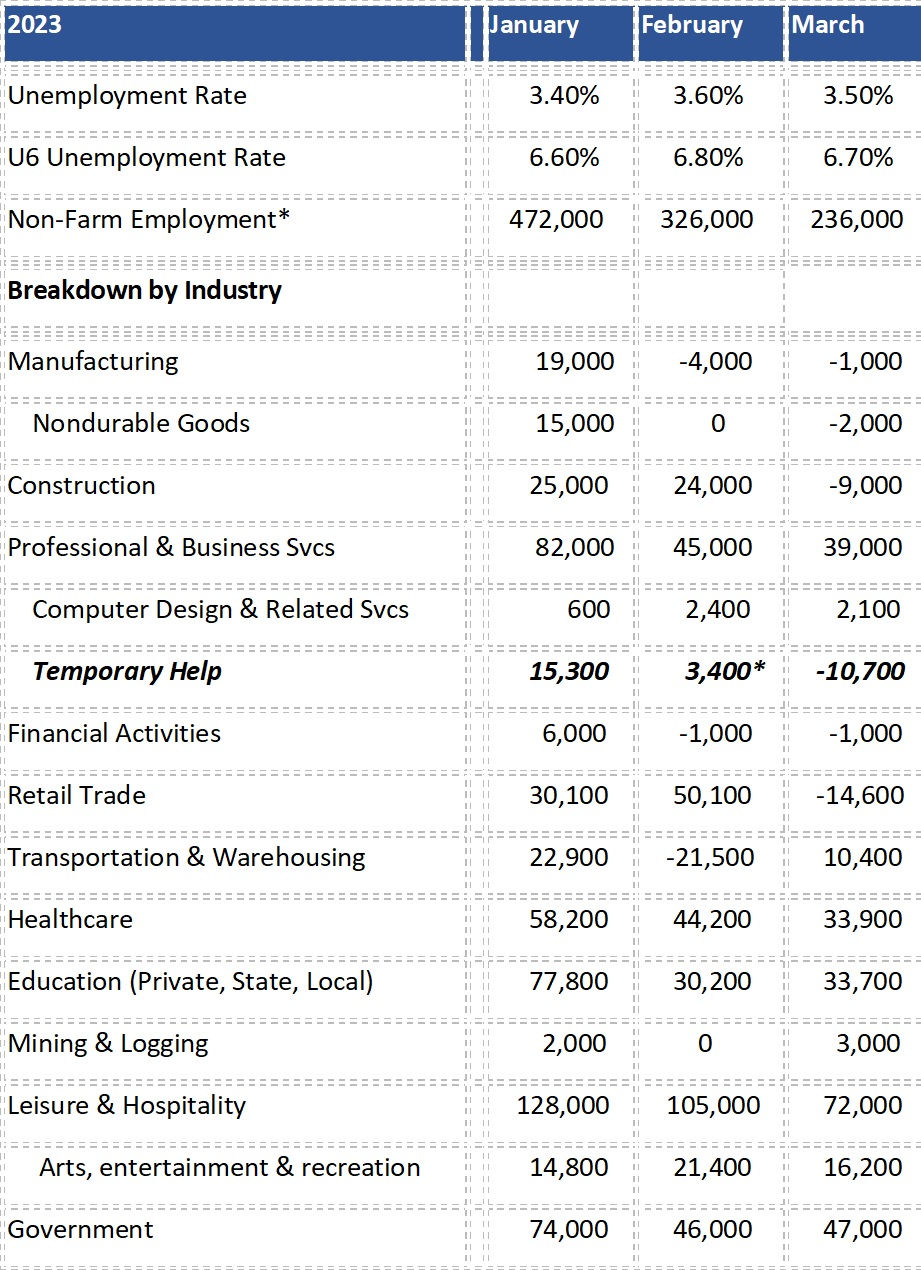

The March Jobs Report shows a continuing softening in the labor market. Keep in mind its not falling off a cliff - but certainly not as robust as last year. Much more on that in this issue.

As the labor market cools, hard and anecdotal data suggests light industrial clients are experiencing shorter work weeks for contract employees.

Consumer Price Index and bank earnings are reported this week. These along with the jobs report should give us more clues on the direction of the economy, interest rates, and how close the economy is on achieving a soft landing

· Temp Help is down in March.

· Nonfarm payrolls increased by 236,000 for the month, below economists’ estimate.

· Wage growth came in at just .3% last month, a bit higher than last month.

· The JOLTS report estimates 9.9mm open jobs in February, down 637,000 since January.

Analysis of the March Employment Report

· The average hourly work week was down again this month.

· Job gains were revised DOWN for the last two months.

· The Challenger Report showed job cuts on the rise with 89,703 layoffs announced in March, a 15% gain from February.

· Continuing jobless claims hit 1.823 million, a level not seen since December 2021.

· According to the JOLTS report, the number of open jobs decreased in February.

This is the first time in 10 years that there are less 10mm open jobs in the US.

We may be close to saying "soft landing".

For those looking to take a deeper dive:

· A more encompassing measure of unemployment (U6) that includes discouraged workers and those holding part-time jobs for economic reasons is down to 6.6%.

· Prime age labor force participation rate (ages 25-54) held at 83.1%.

· The overall labor force participation was up .1% to 62.6%. This number has steadily risen since October but still sits .6% below the level of February 2020.

· In March, average hourly earnings for all employees on private nonfarm payrolls rose by 9 cents, or 0.3 percent, to $33.18. Over the past 12 months, average hourly earnings have increased by 4.2 percent. In March, average hourly earnings of private-sector production and nonsupervisory employees rose by 9 cents, or 0.3 percent, to $28.50.

· The average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.4 hours in March. In manufacturing, the average workweek was unchanged at 40.3 hours, and overtime remained at 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.9 hours.

· APD is reported that 145,000 jobs were added last month.

Source: ADP, BLS, CNBC, Fox News

JOB OPENINGS AND LABOR TURNOVER – FEBRUARY 2023

The number of job openings decreased to 9.9 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations changed little at 6.2 million and 5.8 million, respectively. Within separations, quits (4.0 million) edged up, while layoffs and discharges (1.5 million) decreased. This release includes estimates of the number and rate of job openings, hires, and separations for the total nonfarm sector, by industry, and by establishment size class.

Job Openings

On the last business day of February, the number and rate of job openings decreased to 9.9 million (-632,000) and 6.0 percent, respectively. The largest decreases in job openings were in professional and business services (-278,000); health care and social assistance (-150,000); and transportation, warehousing, and utilities (-145,000). The number of job openings increased in construction (+129,000) and in arts, entertainment, and recreation (+38,000). (See table 1.)

Hires

In February, the number and rate of hires changed little at 6.2 million and 4.0 percent, respectively. Hires increased in federal government (+8,000).

Separations

Total separations include quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations include separations due to retirement, death, disability, and transfers to other locations of the same firm.

In February, the number of total separations changed little at 5.8 million. The rate was little changed at 3.7 percent. The number of total separations decreased in transportation, warehousing, and utilities (-45,000) but increased in educational services (+21,000)

In February, the number of quits edged up to 4.0 million (+146,000), and the rate was little changed at 2.6 percent. Quits increased in professional and business services (+115,000); accommodation and food services (+93,000); wholesale trade (+31,000); and educational services (+18,000). The number of quits decreased in finance and insurance (-39,000).

In February, the number of layoffs and discharges decreased to 1.5 million (-215,000). The rate changed little at 1.0 percent. Layoffs and discharges decreased in professional and business services.

The number of other separations was little changed in February at 291,000. Other separations increased in finance and insurance (+19,000) and in wholesale trade (+10,000).

Establishment Size Class

In February, establishments with 1 to 9 employees saw little change in their job openings rate, hires rate, and total separations rate; but the layoffs and discharges rate decreased. Establishments with more than 5,000 employees saw little change in their hires rate and total separations rate while the job openings

rate decreased.

____________

The Job Openings and Labor Turnover Survey estimates for March 2023 are scheduled to be released on Tuesday, May 2, 2023, at 10:00 a.m. (ET).

Comments